Key Takeaways

- Stay informed about demographic trends that influence homebuyer preferences and market competition.

- Track mortgage rate changes to optimize your financial strategy and timing.

- Assess how remote work trends should influence your location and home feature priorities.

- Monitor housing inventory to identify favorable buying opportunities.

In today’s fast-paced real estate environment, arming yourself with the latest information is crucial if you want to make informed and savvy homebuying decisions. Whether you’re searching for your first property or looking to upgrade, navigating market dynamics can be challenging. Working with a local specialist like Pensacola FL real estate expert Brooke DeWall can offer invaluable guidance through the complexities of the current market.

Rapid shifts—including technological advancements, demographic changes, and fluctuating mortgage rates—mean buyers must be more prepared than ever. Understanding these influences can ensure you not only find the right home but also secure it at favorable financial terms. As remote work and evolving lifestyle needs continue to transform housing preferences, adapting your home search to these realities is crucial to success.

Demographic Shifts Influencing Buyer Preferences

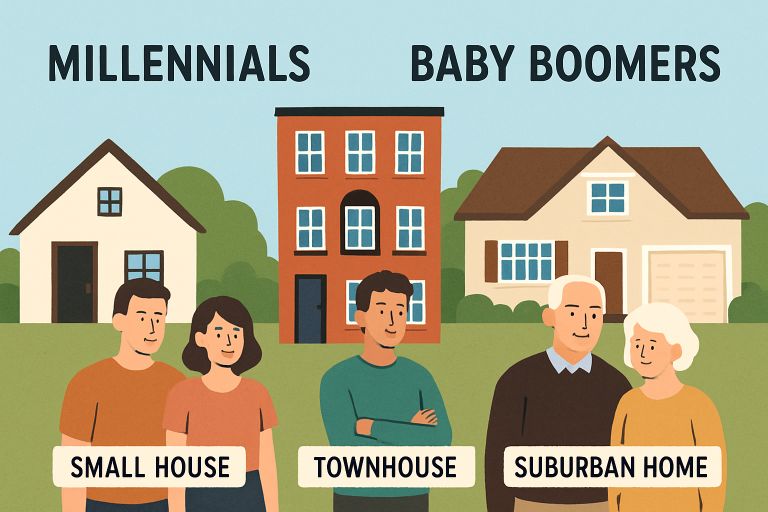

Homebuyer profiles now favor Millennials, who prioritize affordability, flexible spaces, and vibrant communities, making urban and hybrid neighborhoods attractive. Baby Boomers seek low-maintenance, downsized homes. These trends affect property availability and pricing, with Millennials competing for entry-level homes in walkable areas and downsizers preferring townhomes and condos. Understanding these preferences helps set realistic expectations and guides your search.

Mortgage Rates: A Critical Factor

One of the biggest challenges for buyers in recent years has been the unpredictability of mortgage rates. As of 2025, rates have settled around 6.5%, granting many buyers renewed confidence. This stabilization is expected to stimulate more activity and support overall market health, though it’s crucial to remember that even small fluctuations can rapidly alter affordability. According to Bankrate, keeping a close watch on trends and locking in a favorable rate at the right time can save thousands over the life of a loan.

Engaging with mortgage professionals early in your search is a smart move, as it helps you understand how rate changes will affect your monthly payment and long-term costs. Even seasoned buyers should consider how stabilization or sudden price hikes can alter their purchasing power or widen the pool of competing offers.

Remote Work Reshaping Housing Demand

The pandemic accelerated the remote work movement, and companies are now solidifying hybrid or fully remote workplace policies. For buyers, this means location is increasingly flexible, prioritizing space for home offices, larger lots, and outdoor amenities over access to traditional business centers. As a result, suburban and rural communities outside of major cities have seen increased interest and competitive bidding.

Homes featuring private offices, high-speed internet connectivity, and adaptable layouts are now in high demand. The shift has led buyers to explore regions that previously offered little draw, and this transformation is reshaping communities nationwide. As you assess properties, think about how long-term changes in work habits could alter your daily routine, travel needs, and your family’s quality of life.

Inventory Levels and Market Dynamics

Another seismic shift is the notable 30.6% year-over-year increase in available homes as of April 2025. For buyers accustomed to sparse listings, this upswing signals a move toward a more balanced market, where upward pricing pressure could ease and competition may become less intense. Greater inventory provides more options, more negotiation power, and increased potential for successful offers, especially as sellers adjust to changing expectations.

Paying attention to local trends is critical, as some regions may witness faster shifts in available housing than others. Real estate professionals advise reviewing historical price trends, new listing volumes, and average time-on-market statistics to forecast where conditions are ripest for negotiation or where further patience may be required.

Leveraging Technology in the Homebuying Process

Technology is streamlining the real estate industry with online listings, virtual tours, digital contracts, and remote closings, enabling buyers to explore and secure homes from anywhere. This wider access enables buyers to make faster, more informed decisions before visiting. Partnering with tech-savvy agents boosts this with tools like drone footage, AI price analysis, and neighborhood insights. Digital solutions improve convenience and shorten transaction times, crucial for buyers at all levels.

Affordability Challenges and Solutions

Affordability remains a key barrier for many, especially first-time homebuyers. While moderating price growth and more inventory offer hope, higher prices, steeper mortgage rates, and ongoing bidding wars present challenges. Initiatives like down payment assistance, tax credits, and loan programs help qualified buyers. Prospective buyers should research incentives and work with agents to identify lender programs or grants that offer financial relief. With careful planning, those facing affordability issues can still find pathways to homeownership.

Conclusion

Succeeding in today’s dynamic real estate market takes more than luck. Informed buyers who monitor demographic shifts, fluctuations in mortgage rates, the impact of remote work, inventory changes, and available technological advantages have a clear edge. By leveraging expert advice, harnessing digital tools, and staying alert to available incentives, you can confidently pursue your real estate goals—whatever your stage of the journey.