Table of Contents

- Introduction

- What Is Probate?

- Why Probate Matters After Someone Passes Away

- Basic Steps In Probate Proceedings

- Common Myths About Probate

- Probate vs Non-Probate Assets

- How Long Does Probate Take?

- Ways To Streamline The Probate Process

- Helpful Resources And Next Steps

Introduction

Many families encounter the term “probate” for the first time during a loss, and it’s common to associate it with legal complexity or high emotion. The reality, however, is that probate is a structured legal process designed to ensure a deceased person’s financial affairs are resolved and their final wishes are carried out. Familiarizing yourself with the process can relieve much of the anxiety if you’re appointed as an executor or find yourself involved in probate. For those who feel uncertain or face particularly complex estates, consulting a Robinson & Henry probate attorney can help clarify your responsibilities and reduce the likelihood of costly mistakes.

Instead of viewing probate solely as a bureaucratic hurdle, it is helpful to approach it as a series of straightforward steps. Each phase honors the deceased’s intentions and the rights of heirs, creditors, and other parties. By understanding what needs to be done and being prepared for what to expect, anyone can navigate probate more confidently and with less stress. Whether the estate is small with a single bank account or involves multiple properties and complex investments, the fundamentals of probate remain surprisingly consistent across cases.

What Is Probate?

Probate is the court-supervised legal procedure used to validate a person’s last will (if one exists), account for all assets, pay necessary debts and taxes, and distribute what remains to the rightful beneficiaries. While some worry this means handing control entirely to the courts, the probate process is typically straightforward, especially if the deceased left behind clear instructions and organized paperwork.

The court plays a vital but limited role: It verifies the will’s authenticity, appoints a personal representative (commonly known as the executor or administrator), and ensures estate administration follows state laws. Not all assets pass through probate, but those are managed transparently to prevent conflicts or unfair distributions. Probate still occurs for individuals without a will, but state “intestacy” laws set the inheritance rules.

Why Probate Matters After Someone Passes Away

The goal of probate is not just to distribute wealth—it’s about fairness and order. The system exists to double-check that all assets and debts are accounted for and that everyone entitled to a share receives it, including the deceased’s creditors, who may be owed money. Without probate, heirs and beneficiaries could face unclear or competing inheritance claims, inviting confusion and possible legal battles.

Probate also serves a protective function. If there’s disagreement over a will’s meaning or someone feels left out or mistreated, the court can resolve disputes according to the law. For example, estranged family members or previously unknown creditors may surface, but the probate court ensures their claims are considered appropriately. By providing a transparent legal pathway, probate reassures everyone involved that assets are distributed based on clear rules, not on who speaks up first or loudest.

Basic Steps In Probate Proceedings

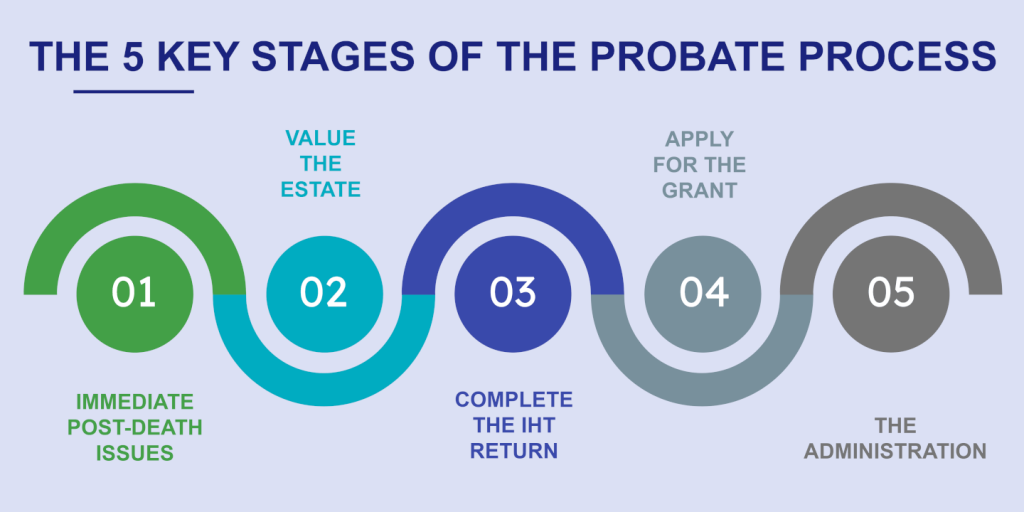

Although probate varies from state to state, the key steps are consistent. Here’s a closer look at what typically occurs:

- Filing the Will or Petition: Probate is initiated by submitting the death certificate, will (if there is one), and other required forms to the court. Without a will, a petition is filed to begin probate under state intestacy laws.

- Appointment of Personal Representative: The court designates an executor (named in the will) or an administrator (if there’s no will). This person is legally responsible for managing the estate’s affairs.

- Notice to Heirs and Creditors: The court requires all potential heirs, beneficiaries, and creditors to be informed, allowing them to challenge the proceedings or make claims.

- Inventory and Appraisal of Assets:Real estate, bank accounts, stocks, personal property, and other assets are cataloged and, if necessary, appraised to determine value.

- Payment of Debts and Taxes: The estate must settle debts, which include mortgages, personal loans, taxes, and final bills. Only once obligations are met can assets be distributed.

- Distribution of Remaining Assets:The remaining property—after debts, expenses, and taxes—is allocated to beneficiaries per the will or, lacking a will, by law.

Each step allows all parties to review progress, resolve misunderstandings, and voice concerns. Following the structured approach ensures legal compliance and fairness from start to finish.

Common Myths About Probate

Probate is often misunderstood, mainly due to dramatic portrayals in film and television. One of the most common misconceptions is that probate drags on for years and depletes entire estates in fees. In reality, many ordinary estates move through probate relatively quickly, often in less than a year, provided there are no significant disputes and paperwork is complete from the start.

Another myth is that probate always costs a fortune. While there are unavoidable fees (typically court costs and reasonable compensation for the executor and any attorneys), these expenses are usually a small fraction of the estate’s total value, unless particularly complex legal or tax issues are involved. Additionally, some believe all estates must go through probate; many assets transfer outside the process, and some states offer simplified procedures for small estates.

Probate vs Non-Probate Assets

Understanding which assets are subject to probate can save families time and money. Generally, probate applies to assets solely in the deceased’s name, such as a titled car, house, or checking account without a designated beneficiary. A thorough inventory helps clarify which items require court oversight.

Many other valuable assets never enter probate due to existing legal mechanisms. These may include:

- Life insurance policies with appropriately named beneficiaries

- Bank or investment accounts that are “payable on death” or “transfer on death”

- Jointly owned real estate with “right of survivorship” provisions

- Retirement accounts—like IRAs or 401(k)s—when a beneficiary is listed

Properly structuring accounts and property in advance while keeping beneficiary documents up to date helps minimize the assets that must pass through probate and makes life easier for loved ones.

How Long Does Probate Take?

The duration of probate proceedings varies but is usually dictated by the estate’s size, complexity, and whether conflicts arise. For straightforward estates and attentive executors, timelines can range from several months to a year. According to the American Bar Association, most basic probate cases resolve within a year if uncontested and paperwork is promptly filed.

Delays are common when missing records, ambiguous wills, or family disagreements exist. Tax-related issues or legal claims can also prolong the process, sometimes for years in high-value or complicated cases. For example, estates with multiple properties in different states or significant investment portfolios may encounter slowdowns due to additional legal filings or court review requirements. The key is thorough preparation and prompt communication with all interested parties to avoid bottlenecks.

Ways To Streamline The Probate Process

You don’t have to sit helplessly by as probate unfolds. There are fundamental steps anyone can take, even years in advance, to reduce complications and costs. Keep all estate planning documents—like wills, powers of attorney, and beneficiary forms—organized and updated as life circumstances change. This alone eliminates a surprising number of court-related headaches.

- Hold open, honest conversations with potential heirs and the person you’d like to name executor to align expectations and reduce the risk of future disputes.

- List beneficiaries directly on accounts or policies when available; these assets can escape probate entirely, ensuring your intentions are met with minimal delay.

- Consider trust arrangements that can bypass probate and provide even greater asset control. Trusts come in many forms, and consulting with a qualified legal professional can demystify your options.

- Maintain a master list of all assets, debts, contacts, and account details in a secure but accessible place. Your chosen representative will thank you for your foresight when the time comes.

By planning and relying on trusted advisors, many families discover that probate can be a manageable—sometimes even straightforward—process.

Helpful Resources And Next Steps

There’s no need to go through probate alone or uninformed when so many credible sources can help. For a comprehensive look at standard procedures, terms, and obstacles, the Nolo probate process FAQ offers expert answers to frequently asked questions nationwide. Resources like these can make complicated topics approachable and help you use the best strategies.

Seeking advice at each stage—whether from published guides or professionals safeguards your interests while reducing the likelihood of unintentional missteps. The combination of preparation, knowledge, and expert support can turn what might feel overwhelming into a series of clear, achievable steps.

With reliable guidance, transparent processes, and a realistic understanding of probate, families can honor their loved one’s memory and move forward with fewer burdens during a pivotal time.